Get Your Free Property Analysis

Enter your property details to instantly see your current assessment data, local market facts, and recent sales information to start building your appeal.

This information represents a valuable glimpse into the comprehensive data available to assist you in challenging your assessment.

The 2023 Valuation Spike

Due to a state-mandated reappraisal cycle that captured the peak of the post-pandemic housing boom, Douglas County homeowners saw an average valuation increase of 48% in 2023. This unprecedented hike has led to a property tax "war" in Colorado, making it more critical than ever to ensure your assessment is fair and accurate.

The Challenge of Appealing

While you have the right to appeal, success is not guaranteed. Three out of five homeowners who appealed were denied. Winning requires strong, factual evidence, not just an opinion.

Our Data-Driven Solution

For a single, transparent fee, LocalTaxCut.com delivers comprehensive, property-specific data tailored for your Douglas County appeal. We are not a law firm; we are an information technology company dedicated to empowering homeowners with the data needed to build a compelling case and keep 100% of the savings.

The Power of Evidence

Of the 41% of appeals that succeeded, the average adjustment was between 7% and 7.5%, or about $50,000 in home value. Our data helps you join that successful group.

Discover Your Potential Tax Savings

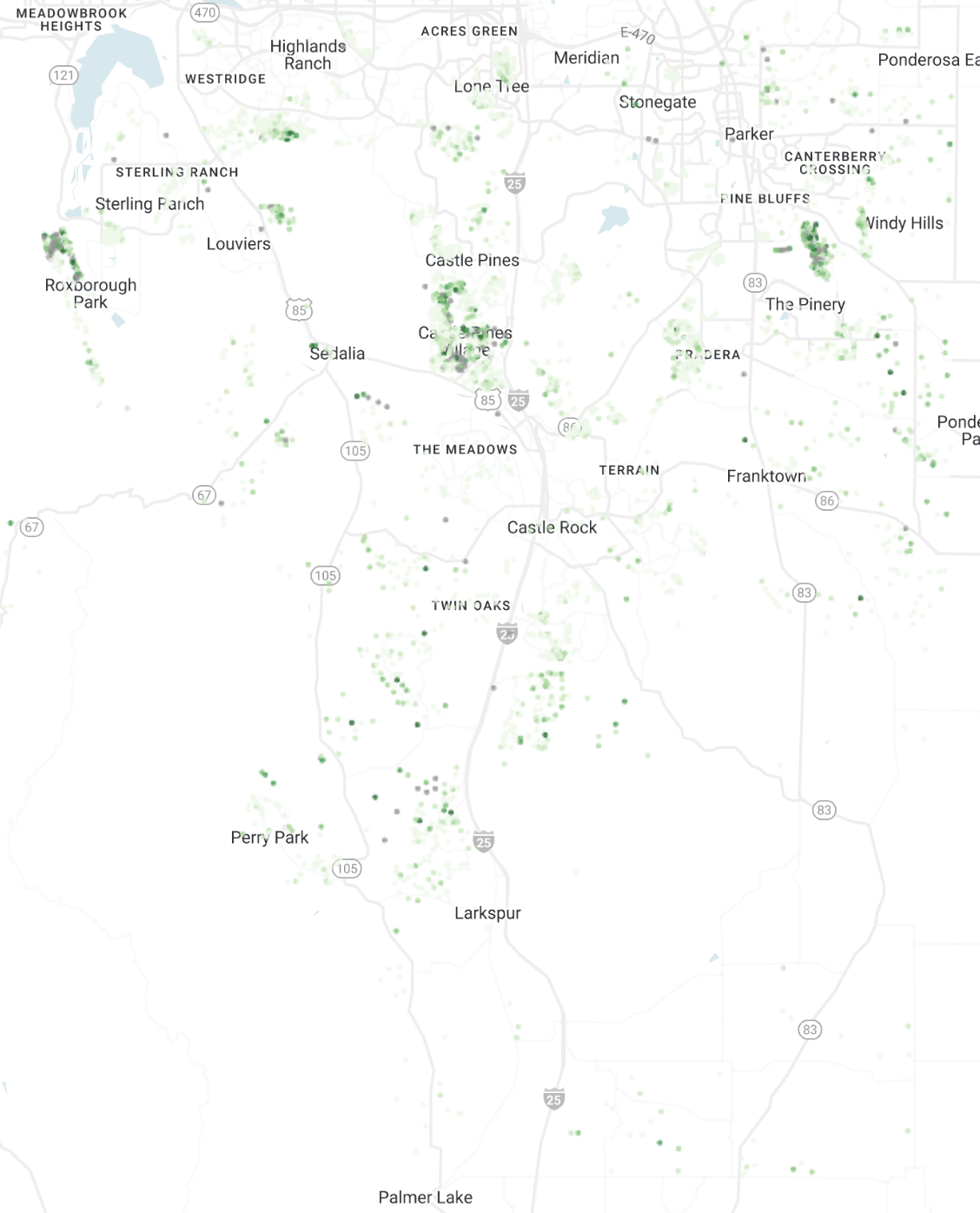

Thousands of Douglas County properties could save $2,000 to $13,780+ annually in property taxes. See where your home could fit on the map.

Potential Tax Savings by Property

Colors scale smoothly from light to dark green based on potential annual tax savings

Unlock Your Tax Savings Potential

- 🎯 Calculate Your Savings: See your potential annual tax savings in seconds

- 📊 Data-Driven Evidence: Get comparable sales and market data to support your appeal

- 💰 Real Savings: Properties are saving $2,000 to $13,780+ per year in property taxes

FREE

Property Lookup

Discover your tax savings potential

Join the 41% of homeowners who successfully reduced their property taxes

How It Works

Three simple steps to arm yourself with the data you need.

Enter Your Address

Get your free, instant property analysis, including your assessment and local market data.

Get Your Full Report

For a flat fee, get our full data package with comparable sales and strategic evidence to build your strongest case.

File Your Appeal

Use our data to confidently file your appeal with the county and keep 100% of your savings.

The Douglas County Appeal Process: A Homeowner's Gauntlet

Level 1: Assessor-Level Appeal (The Primary Funnel)

This is the initial and most critical stage, where you protest your valuation directly with the Douglas County Assessor's Office. The appeal window is narrow and strictly enforced, running annually from May 1 to June 8. A failure to file within this period results in a waiver of your right to appeal for that tax year.

Valid grounds for an appeal include factual errors (e.g., incorrect square footage) or an estimated market value that is demonstrably too high. An inability to pay the resulting tax bill is not a valid basis for an appeal.

The Assessor's Office must mail you a Notice of Determination (NOD) by August 15th.

Level 2: County Board of Equalization (CBOE)

If you are unsatisfied with the Assessor's decision, you may advance your case to the CBOE by filing a written appeal on or before September 15. The CBOE hearings are conducted remotely, and all evidence must be submitted at least two business days in advance. The board must notify you of its decision within five business days of the ruling, no later than early November.

Level 3: State-Level and Judicial Appeals

Should the CBOE's decision remain unsatisfactory, you have three final, and significantly more complex, avenues for appeal within 30-45 days of the CBOE decision:

- Board of Assessment Appeals (BAA): A state-level administrative body.

- District Court: A formal lawsuit involving substantial legal procedures and costs.

- Binding Arbitration: An alternative dispute resolution where the decision is final.

The escalation to state-level appeals underscores the importance of building the strongest possible case at the initial Assessor level.

Douglas County Property Tax Appeal Timeline & Procedures

| Appeal Stage | Governing Body | Filing Window | Key Deadlines | Decision Rendered By |

|---|---|---|---|---|

| Stage 1: Assessor | Douglas County Assessor's Office | May 1 - June 8 | June 8 | August 15 |

| Stage 2: CBOE | County Board of Equalization | Upon receipt of NOD | September 15 | November 1 |

| Stage 3: State-Level | BAA, District Court, or Arbitrator | Within 30-45 days of CBOE decision | Varies | Varies |